The Specialist Search: How Hyper-Focused Search Funds Can Win in the Lower Market (1/2)

This is the first post in a two part series introducing a hyper-focused approach to searching which I’m calling “The Specialist Search.”

There obviously isn't a one-size-fits-all approach to executing a successful search fund, but we can all benefit from experimenting with new strategies.

A Specialist Search is a single-industry focused search fund that leverages their extreme focus to become a differentiated preferred buyer.

Today, in Part I, l’ll share my Observations on the State of Search.

Next week, in Part II, I’ll make my case in support of the Specialist Search.

My goal for these posts is to publicly think through this new approach to search fund deal sourcing with the goal of helping more searchers “win” in the lower market.

Observation 1: Most Searchers Are Industry Agnostic Generalists

While I’ve seen an increase in the concentration of searchers focused on Healthcare and SaaS, most are still looking for traditional (and “tech-enabled”) service businesses.

Many searchers name a few industries in their PPMs, but they’re actually executing what I call a Generalist Search; casting a wide net and examining any company that fits into the traditional search fund strike zone.

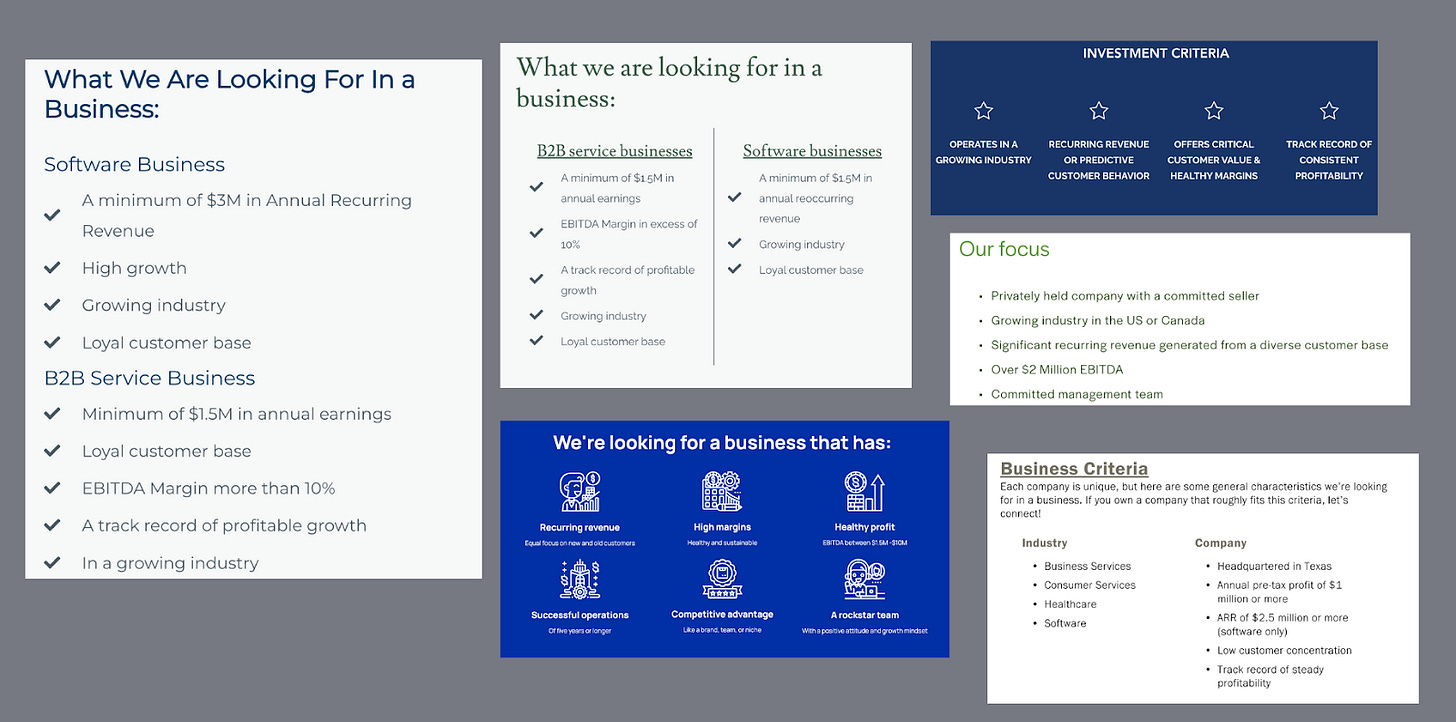

Observation 2: Most Searchers are Checklist Investors

Most searchers screen deals using the traditional Search criteria: +$2m EBITDA, High Gross Margins, Recurring Revenue, Sustained Industry Growth, Asset-Light etc.

The two biggest issues with being a checklist investor are:

You’re attracted to the same businesses as every other checklist investor/searcher and are susceptible to pursuing competitive auctioned deals.

You’re encouraged to review deals that, at first glance, partially fit your checklist but will ultimately end up (in hindsight) being a waste of time.

The problems that arise from being a Generalist Searcher AND a Checklist Investor (namely excessive competition and inefficient decision making) are exacerbated by the following observation…

Observation 3: Most Search Deals Are Easy to Kill

Most +3x MOIC search deals started off as deals that were easy to kill (pass on).

Almost every good search deal teeters on the edge of an investors’ risk tolerance, and if they decide to lower that risk tolerance for any reason, a seemingly good deal can very quickly sour into a passed deal.

As just one anecdotal example, I was told that David Berkal’s first software deal at Banyan (Medicat) was passed on by at least one other traditional searcher before he took it down.

While I’ve seen studies that emphasize the importance of conventional search criteria, I’ve still yet to hear of a deal where the cap table was unanimously “all-in” at first blush.

The problem with using a checklist for search deals that are easy to kill, is that each deal is simultaneously “pregnant with possibilities” AND challenging to build conviction and rally investors behind.

Observation 4: Most Searchers Look The Same

Search fund (and independent sponsor) conferences are filled with guys in Patagonia vests who all look the same (with firms that sound similar; ‘color’ + ‘element’ + ‘capital’).

The irony is that we think our homogeneity is only in our appearance, but that it doesn’t extend to how we present ourselves or into our outreach and conversations with sellers.

Most search funds launch with the same messaging, describe themselves the same way, and use the same: cold emails, databases, website copy, and value propositions.

When Irv Grousbeck first conceived the search fund model, relatively few people were pursuing lower market LBOs. Pitching a business owner on liquidity for retirement and continuing their legacy was rare and valuable.

As AJ Wasserstein and Jeff Stevens wrote in their paper Exploring the Future of EtA: “the world is quite different…. what was once easy pickings is now fraught with competition from fundless sponsors, family offices, private equity firms, and searchers themselves.”

Every seller with a good business has heard the search fund story.

“Liquidity, legacy, and stewardship” are no longer differentiated pitches.

To quote another investor:

“It’s become clear to us this year in particular that the standard approach to searching has become insufficient. We feel this is driven by the commoditized approach, not necessarily by the availability of businesses for sale.”

Observation 5: Searcher Collisions Are Increasing

Several former searchers told me about searcher collisions they witnessed back in the early 2010s, but now, as the model becomes more popular, searchers will continue to compete even more.

Here’s another quote from an institutional investor on searcher collisions:

“It’s happening a lot. We’re seeing a lot of our searchers looking at the same deals. Everyone’s using the same tools, with the same filters, so it’s not surprising that everyone’s running after the same companies…

From our perspective, it’s little bit of a volume game, if we have enough searchers, someone’s going to get the deal... I think the ‘percentage of searchers closing a deal stat’ is going to go down. We can’t deny that the number of searchers in the market, the frequency of outreach, and the changing economy aren’t going to have an impact on the number of searchers finding deals.

I think this is a problem that a lot of people are experiencing but few are openly talking about.”

Observation 6: Searcher Yields Are Decreasing

When I say “Searcher Yields” I mean the percentage of searches that conclude in acquisitions.

According to the '22 Stanford Search Fund Study, the Searcher Yield is reported at 66%. However, I believe this figure is already too high and anticipate a further decrease in the future (including in the upcoming '24 Study).

Paul Graham once wrote that most startups “generally don't die loudly and heroically. Mostly they crawl off somewhere and die.”

The same is true for search funds. I doubt that every burnt out “failed to find” searcher raises their hand to be included in The Stanford Study. Many just wind down their efforts, find new jobs, and quietly update their LinkedIns.

Another institutional search investor said recently:

“When I started [firm], my assumption was that roughly 80% of our searchers would buy a company and that we’d invest in 80% of those deals. So we’d end up supporting the acquisitions of 65-70% of the searchers we’d backed.

What we started seeing about 7-8 years ago was that it was more like 60% of our searchers were finding deals and we were only investing in 75% of those deals, which meant that we were actually only backing 40-45% of our searchers…”

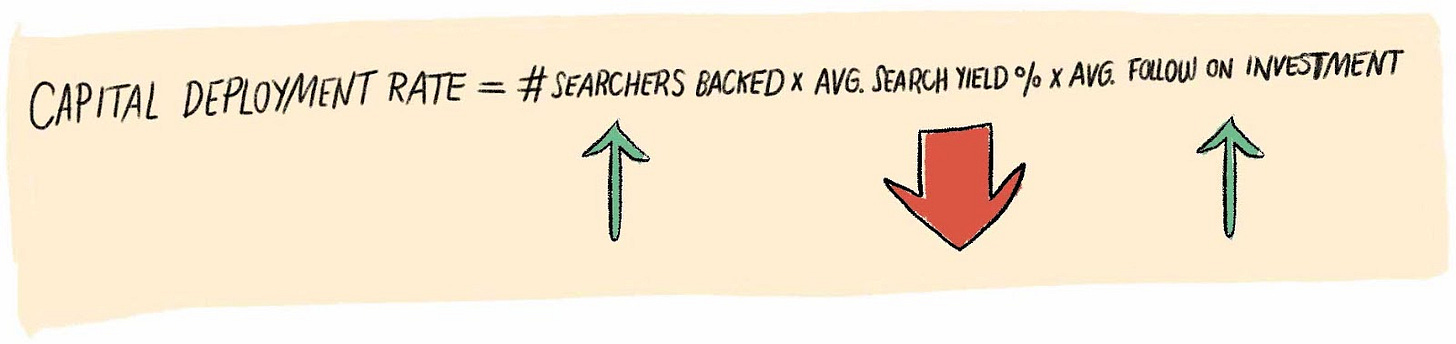

As the search industry becomes Private Equity and focuses on putting money to work, one of the most important equations for investors is their capital deployment rate:

As searcher yields decrease, a search investor has two levers to pull. Either they relax on deal quality to increase their follow on investment OR they back more searchers.

Today with more investors entering the ecosystem, several investors have said they’re seeing more relaxation on valuation AND a record number of new funds launched.

Enter The Specialist Search

So… considering that most searchers are generalist checklist investors and there’s a growing sentiment that the conventional approach “is no longer sufficient,” the question arises: how can we improve search outcomes?"

We should experiment with new approaches and embrace the Specialist Search.

The rant continues in Part II: The Specialist Search.